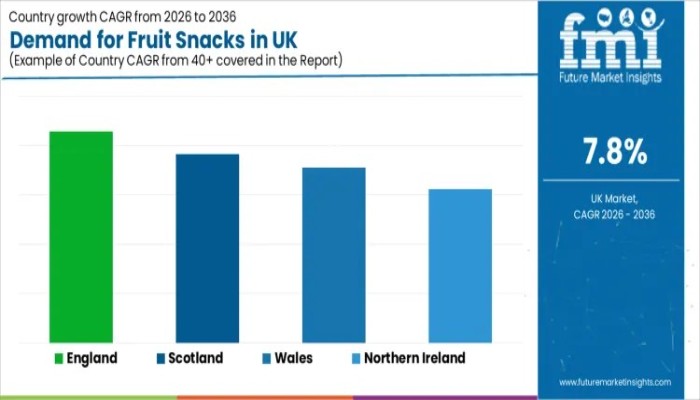

Demand for Fruit Snacks in UK to Surpass USD 1,262.4 Million by 2036 as On-the-Go Snacking Fuels 7.8% CAGR

Scotland grows at 7.6%, driven by steady household demand, trust-led choices, and premium organic cues, with repeat family snack buying boosting retailers.

NEWARK, DE, UNITED STATES, January 21, 2026 /EINPresswire.com/ -- Demand for fruit snacks in the United Kingdom is projected to grow from USD 596.3 million in 2026 to USD 1,262.4 million by 2036, expanding at a compound annual growth rate (CAGR) of 7.8%, according to the latest industry outlook covering the 2026–2036 period. The growth trajectory reflects a structural change in everyday snacking behavior, where consumers increasingly favor portable, shelf-stable, and portion-controlled products that balance convenience with a fruit-based identity.

Fruit snacks including dried fruits, fruit chips, freeze-dried fruits, fruit leathers or rolls, and fruit-based snack bars, are becoming established “in-between” options. They sit between indulgent confectionery and whole fruit, offering predictable taste, ease of storage, and flexibility across home, work, school, and on-the-go use cases.

Request Your Sample Now – Unlock Growth Potential and Discover Key Market Opportunities!

https://www.futuremarketinsights.com/reports/sample/rep-gb-31634

Market Snapshot: UK Fruit Snacks Outlook (2026–2036)

• Market value (2026): USD 596.3 million

• Forecast value (2036): USD 1,262.4 million

• Forecast CAGR: 7.8%

• Leading region: England (8.6% CAGR)

• Leading product type: Dried fruits (30.9% share)

• Leading product claim: Organic (34.2% share)

• Leading end use: Retail/household consumption (56.4% share)

• Leading sales channel: Store-based retail (62.2% share)

• Leading packaging type: Single-serve packs (32.8% share)

Why Fruit Snacks Are Gaining Ground in the UK

UK snacking patterns continue to evolve around portability, portion discipline, and flexible eating occasions. Fruit snacks align with these habits because they require no preparation, travel well, and deliver consistent taste. Families rely on them for lunchboxes, office workers treat them as desk snacks, and fitness-oriented consumers use them as quick carbohydrate sources or substitutes for sweets.

The category’s expansion is also shaped by product claims and regulatory context. Organic positioning leads the market with a 34.2% share, reflecting how trust signals have become central to everyday food choices. For many shoppers, organic certification acts as a shorthand for minimal processing and ingredient transparency, influencing formulation, sourcing, and packaging decisions across the value chain.

At the same time, HFSS (High Fat, Sugar, and Salt) promotion and placement restrictions are reshaping how snack products compete for visibility in-store. Fruit-led snacks benefit from stronger health perception and broader household acceptance, supporting permissible placement strategies where traditional confectionery faces tighter controls.

How the Market Is Segmented

Product Type: Dried Fruits Anchor Everyday Usage

Dried fruits hold the largest product share at 30.9%, driven by familiarity, versatility, and trust. Consumers understand how dried fruits fit into daily routines—whether eaten alone, mixed with nuts, added to yogurt, or used in baking. From an operational standpoint, dried fruits offer retailers strong shelf stability, predictable replenishment, and flexible merchandising across snack aisles, health sections, and impulse displays.

Product Claim: Organic Shapes Trust-Based Demand

Organic claims account for 34.2% of demand, highlighting the UK market’s emphasis on credibility and certification. Organic positioning supports premium pricing and repeat purchase behavior but also requires disciplined supply chains and compliance with established standards. Certification expectations influence ingredient sourcing, processing controls, and labeling accuracy, reinforcing retailer confidence during audits and listings.

End Use: Retail and Household Consumption Dominates

Retail and household use represents 56.4% of total demand, underlining the role of pantry stocking and routine snacking. Households purchase fruit snacks as default options for both adults and children, supporting consistent volume and repeat buying. Foodservice and HoReCa channels contribute through cafés and grab-and-go formats, while industrial use remains relevant for inclusions and composite products.

Sales Channel: Physical Retail Remains Central

Store-based retail leads with a 62.2% share, reflecting the importance of physical discovery and impulse purchasing in snack categories. Shoppers often select fruit snacks alongside adjacent products such as nuts, cereals, and granola. While online retail continues to grow—particularly for subscriptions and niche dietary needs—brick-and-mortar stores remain critical for trial, comparison, and habitual purchasing.

Packaging: Single-Serve Packs Lead On-the-Go Use

Single-serve packs account for 32.8% of packaging demand, driven by commuting, school, gym, and office consumption. These formats support portion control and work effectively in checkout zones and meal-deal adjacencies. Multi-serve packs remain important for family stocking, while resealable pouches gain traction by preserving texture and freshness after opening.

Regional Outlook Across the UK

• England (8.6% CAGR): Leads growth due to dense retail networks, faster product trial, and wider distribution.

• Scotland (7.6% CAGR): Supported by steady household consumption and strong interest in trusted, premium cues such as organic claims.

• Wales (7.1% CAGR): Growth driven by practical value formats, including resealable and multi-serve packs.

• Northern Ireland (6.2% CAGR): Expansion reflects structured retail patterns and initiatives focused on healthier food environments.

Competitive Landscape and Industry Participants

Competition in the UK fruit snacks market is defined by taste retention, claim credibility, packaging convenience, and shelf execution. Brands compete on texture variety, ingredient simplicity, and the ability to maintain quality across extended shelf life.

Key companies profiled include:

• Danone SA – leveraging health-forward positioning and broad consumer reach

• Nestlé SA – competing through scale, distribution strength, and multi-format portfolios

• Yakult Honsha Co., Ltd. – focusing on nutrition-linked brand trust

• ADM – supporting the category through ingredient processing and supply chain capabilities

• Kerry Group – providing flavor innovation and application expertise for fruit-based snacks

Why FMI: https://www.futuremarketinsights.com/why-fmi

Related Reports Insights from Future Market Insights (FMI)

Food Additives Size Market https://www.futuremarketinsights.com/reports/food-additives-size-market

Manjistha Extract Market https://www.futuremarketinsights.com/reports/manjistha-extract-market

Low-Sodium Olive Brine Flavor Systems Market https://www.futuremarketinsights.com/reports/low-sodium-olive-brine-flavor-systems-market

Caffeic Acid Market https://www.futuremarketinsights.com/reports/caffeic-acid-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.